Home Mortgage Tips That Can Make Your Life Easier

Article writer-Bernard Rich

When you realize the time has come to buy a home, many thoughts will cross your mind. One of the first is often the fact that you need to seek out a mortgage to fulfill your dream. The tips below will help you get the job done right so you can move quickly.

Prepare your paperwork before applying for a mortgage. There are many items that a lender will require. These items include the last two or three years worth of tax returns, copies of each of your monthly credit card statements and installment loans. Three months bank statements and two months worth of pay stubs are also needed for approval.

To make your application for a mortgage fast and easy, make electronic copies of your last two pay checks, two recent bank statements, W2s, and tax information. Lenders will ask for all of this information to go with the application and having them on hand in electronic format makes it easy to supply this information.

Get a pre-approval letter for your mortgage loan. A pre-approved mortgage loan normally makes the entire process move along more smoothly. It also helps because you know how much you can afford to spend. Your pre-approval letter will also include the interest rate you will be paying so you will have a good idea what your monthly payment will be before you make an offer.

Don't make any sudden moves with your credit during your mortgage process. If your mortgage is approved, your credit needs to stay put until closing. After a lender pulls up your credit and says you're approved, that doesn't mean it's a done deal. Many lenders will pull your credit again just before the loan closes. Avoid doing anything that could impact your credit. Don't close accounts or apply for new credit lines. Be sure to pay your bills on time and don't finance new cars.

It is likely that your mortgage lender will require a down payment. In the past, home owners often had the ability to get a loan without having to offer a down payment up front. That is mostly not the case anymore. Ask what the down payment has to be before you send in your application.

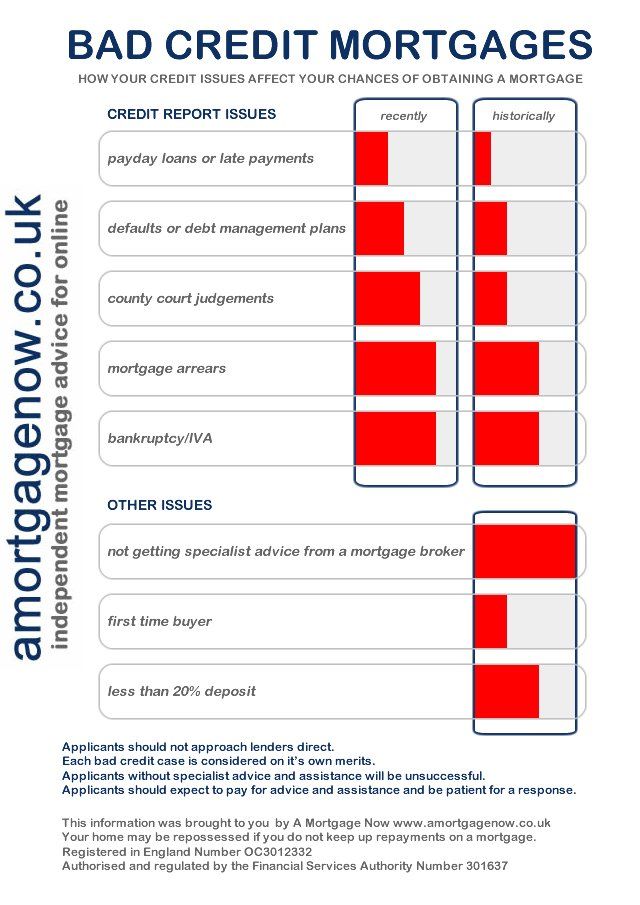

Know your credit score before going in to get a mortgage. Your potential lender will do their own homework on this, but you should arm yourself with the intel as well. Knowledge is power in terms of the negotiations to follow. If you aren't clear on your strengths and weaknesses, then a lender can more easily use the knowledge against you.

Don't forget to calculate closing costs when applying for a mortgage, particularly if this is your first time. Above and beyond the down payment, numerous charges exist simply for processing the loan, and many are caught off guard by this. You should anticipate paying up to four percent of the mortgage value in total closing costs.

If your mortgage is for thirty years, making additional payments can help you pay it off more quickly. This will pay off your principal. If you pay more regularly, you are going to cut down the interest you need to pay, and you'll be able to be done with your loan that much faster.

Explore entities other than traditional banks when seeking a mortgage. If you are able to borrow from family or have another option, you can put more money down. You may also look into credit unions that tend to offer terrific rates. When you are searching for a mortgage, consider all your options.

Refinancing a home mortgage when interest rates are low can save you thousands of dollars on your mortgage. You may even be able to shorten the term of your loan from 30 years to 15 years and still have a monthly payment that is affordable. You can then pay your home off sooner.

Avoid paying Lender's Mortgage Insurance (LMI), by giving 20 percent or more down payment when financing a mortgage. If you borrow more than 80 percent of your home's value, the lender will require you to obtain LMI. LMI protects the lender for any default payment on the loan. It is usually a percentage of your loan's value and can be quite expensive.

Never assume that a mortgage is going to just get a home for you outright. Most lenders are going to require you to chip in a down payment. Depending on the lender, this can be anywhere from 5 percent to a full fifth of the total home value. Make sure you have this saved up.

If you need to make repairs to your home you may want to consider a second home mortgage. As long as you have a good history of paying on time you should be able to get a great rate, and by improving your home you are increasing its value. Just be sure that you will be able to make the payments.

Speak with a broker and ask them questions about things you do not understand. It is your money. You have to understand fully what is happening. Be sure the broker has your contact information. Check your email on a regular basis to see if they need any documentation or information updates.

If you have less than stellar credit, it would be very helpful for you to save more money toward your down payment. You should have at least 20 percent saved toward your down payment to increase the odds of getting approved.

Make sure you completely understand which mortgage and any related fees will be before you sing your home mortgage agreement. There are going to be costs for closing which need to be itemized. This also includes commission fees and the other charges. These things may be able to be negotiated with the lender or even the seller.

Pay off more than your minimum to your home mortgage every month. Even $20 extra each month can help you pay off your mortgage more quickly over time. Plus, it'll mean less interest costs to you over the years too. If you can afford more, then feel free to pay more.

Never choose https://www.marketscreener.com/quote/stock/VP-BANK-AG-27737194/news/VP-Bank-increased-its-assets-under-management-by-8-1-per-cent-in-2021-posted-Group-net-income-of-39691757/ from a company that asks you to do unscrupulous things. If a rep is asking you to claim more than you make to secure the mortgage, it's not a good sign that your mortgage is in good hands. Walk away from visit the following site as you can.

After reading the tips above, you probably realize that there's a lot about the subject you weren't aware of. That's okay; many people don't have the first idea about how to shop for a great mortgage. Just make sure you're willing to learn about the subject before signing your name to anything.